Percentage of federal income tax withheld per paycheck

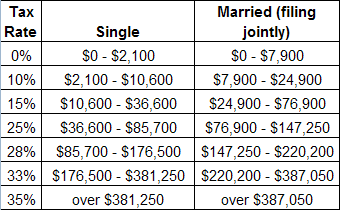

Compare Your 2022 Tax Bracket vs. In 2021 the first 142800 of earnings is subject to the Social Security tax 147000 for 2022.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

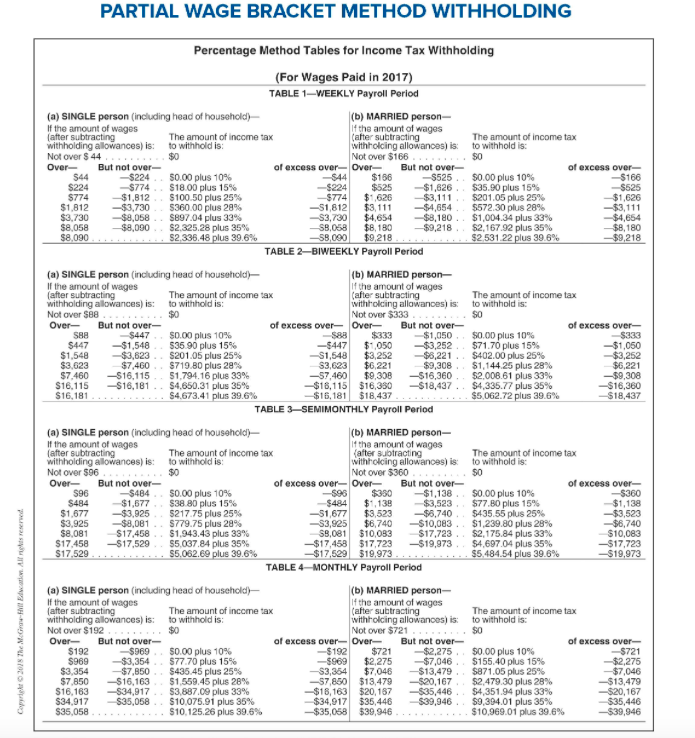

. You pay the tax on only the first 147000 of your earnings in 2022. Per 2020 Publication 15-Ts percentage method table page 58 this employee would. There are two federal income tax withholding methods for use in 2021.

10 12 22 24 32 35 and 37. There are two main methods small businesses can use to calculate federal withholding tax. Your effective tax rate is just under 14 but you are in the 22.

There are seven federal tax brackets for the 2021 tax year. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. The 2019 employer and employee tax rate for.

For a hypothetical employee with 1500 in weekly. The federal withholding tax has seven rates for 2021. There is a set percentage however for Social security 62 and Medicare 145 Federal.

Federal income tax and FICA tax. For 2022 employees will pay 62 in Social Security on the. FICA taxes consist of Social Security and Medicare taxes.

To arrive at the amount subject to withholding subtract 330 from 1700 which leaves 1370. Paycheck Deductions for 1000 Paycheck. Ad Discover Helpful Information And Resources On Taxes From AARP.

These are the rates for. Wage bracket method and percentage method. The per pay period input refers to federal income tax withheld per paycheck.

What Is the Percentage of Federal Taxes Taken out of a Paycheck. If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. For example if your pay is more than 209 but not more than 721 your employer will multiply your pay by 15 percent and add 1680 to the result to determine your tax withholding.

How Your Paycheck Works. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. The wage bracket method and the percentage method.

22 on the last 10526 231572. 10 12 22 24 32 35 and 37. You pay the tax on only the first 147000 of your.

Each employer withholds 62 of your gross income for Social. Between 2021 and 2022 many of the changes brought about by the Tax Cuts and Jobs Act of 2017 remain the same. Your wages after allowances that exceed 1548 would be subject to a 25-percent tax plus a flat amount of 20105.

The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The percentage of tax withheld from your paycheck depends on what bracket your income falls in. Your 2021 Tax Bracket To See Whats Been Adjusted.

The federal withholding tax. 2022 income tax withholding tables. These amounts are paid by both employees and employers.

Income taxes in the US. The federal withholding tax rate an employee owes depends on their income. The amount withheld per paycheck is 4150 divided by 26 paychecks or.

Subtract 1548 from 222491 to arrive at 67691 which. Your bracket depends on your taxable income and filing status. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings.

The more deductions you claimed the less tax was withheld from your paycheck. Youd pay a total of 685860 in taxes on 50000 of income or 13717. How much tax is deducted from a 1000 paycheck.

This money goes toward.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Payroll Taxes Methods Examples More

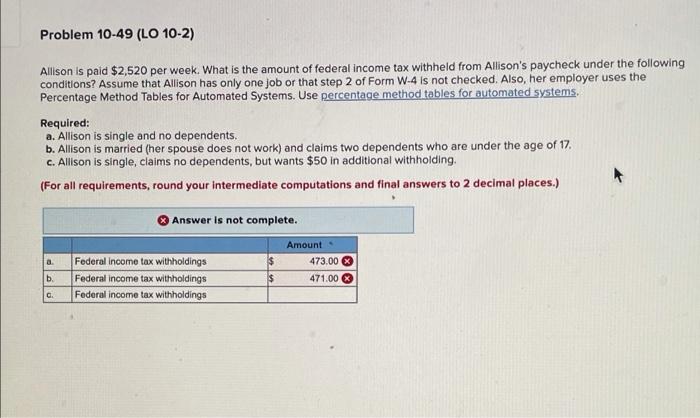

Solved Allison Is Paid 2 475 Per Week What Is The Amount Chegg Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Income Tax I M Bad At Spending Money

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Withholding Tax Youtube

Solved Allison Is Paid 2 325 Per Week What Is The Amount Chegg Com

Solved Problem 10 49 Lo 10 2 Allison Is Paid 2 520 Per Chegg Com

Calculation Of Federal Employment Taxes Payroll Services

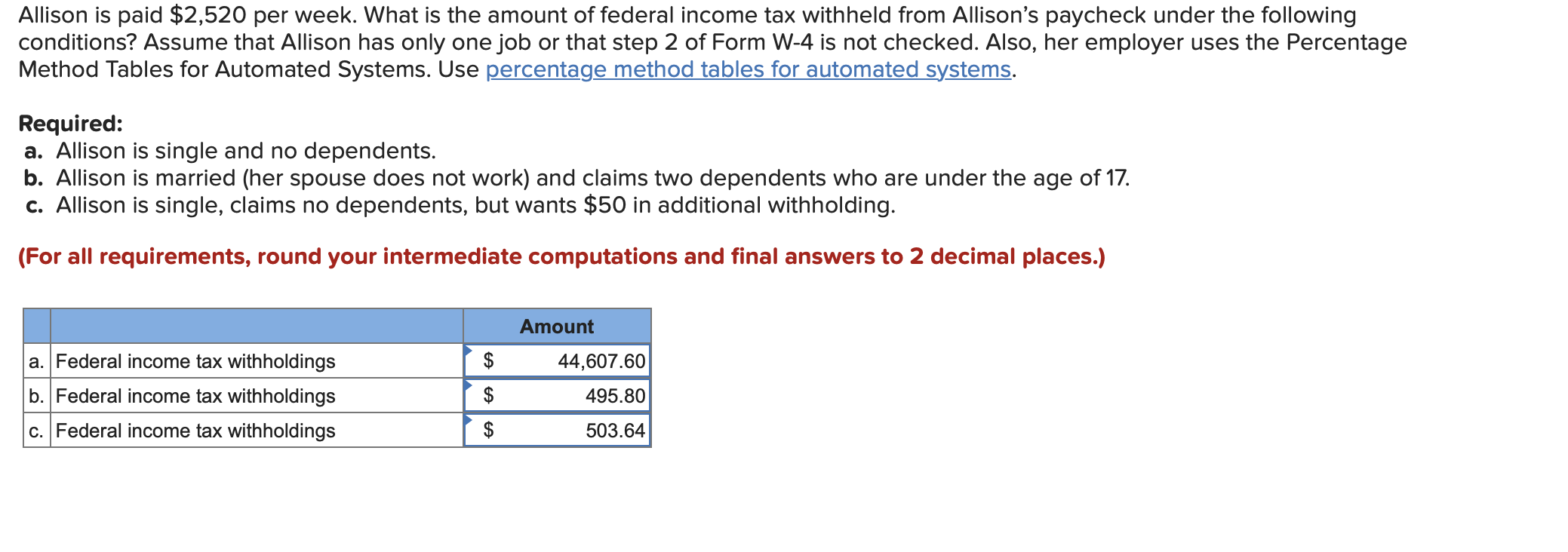

Solved Allison Is Paid 2 520 Per Week What Is The Amount Chegg Com

Payroll Tax Vs Income Tax What S The Difference

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Income Tax

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Irs New Tax Withholding Tables